Inflation in 2021 is expected to hit 4%. Inflation means the cost of living will rise and, for mortgage holders, knock-on effects could mean the cost of a mortgage becomes higher.

From grocery shopping to electronic goods, prices are rising. The Bank of England now expects UK inflation to rise above 4% by the end of the year, double its 2% target. There are numerous reasons for inflation rising, including shortages caused by temporary factory closures due to the pandemic.

Families across the UK are likely to find their day-to-day spending on both essential and non-essential items rise. But if you’re paying a mortgage, steps taken to limit the impact of inflation could have a knock-on effect too.

One of the ways the Bank of England can tackle inflation if it’s rising too quickly is to increase interest rates. A rise in interest rates could affect how much your mortgage repayments are and the long-term cost of borrowing.

Could your monthly mortgage repayments rise?

Interest rates have been low for more than a decade. For mortgage borrowers, it means a mortgage has been cheaper. So, how would an interest rate rise have an impact?

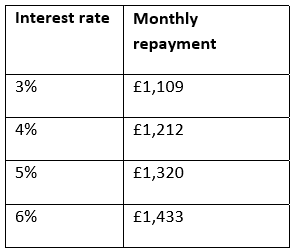

Let’s say you owe £200,000 on a repayment mortgage you’re paying over 20 years. The table below shows how changing interest rates could have an impact on your monthly outgoings.

Source: Money Saving Expert

Over the full mortgage term, an interest rate increase can mean the total cost of borrowing is far higher.

In the above scenario, a mortgage holder with a 3% interest rate would pay £66,169 in interest over 20 years. If the interest rate increased to 6%, the total cost of borrowing reaches £143,946. If interest rates begin to climb, it could affect your monthly repayments and total cost.

If the Bank of England increases interest rates, it will have an immediate impact on some mortgage holders.

A tracker-rate mortgage follows the Bank of England’s base rate. So, mortgage holders would see their monthly outgoings increase straight away. A variable mortgage rate follows the lender’s interest rate, which will often follow rises and falls set by the Bank of England. If you have a variable-rate mortgage, your repayments are also likely to rise if an interest rate hike is announced.

Those with a fixed-term mortgage will not be affected immediately. A fixed-term mortgage means your interest rate is fixed for a defined period, often 2, 3, 5 or 10 years. While you wouldn’t be affected straightaway, when your current deal ends and you look for a new mortgage, you could find interest rates are no longer as competitive.

While interest rates could rise in the coming months, it’s important to note that the Bank of England is unlikely to make steep increases. A gradual approach to rising interest rates to pre-2008 levels is far more likely. Reviewing your mortgage now and assessing the impact a rise could have on your outgoings can provide you with more confidence about the future.

Is it time to choose a fixed-rate mortgage?

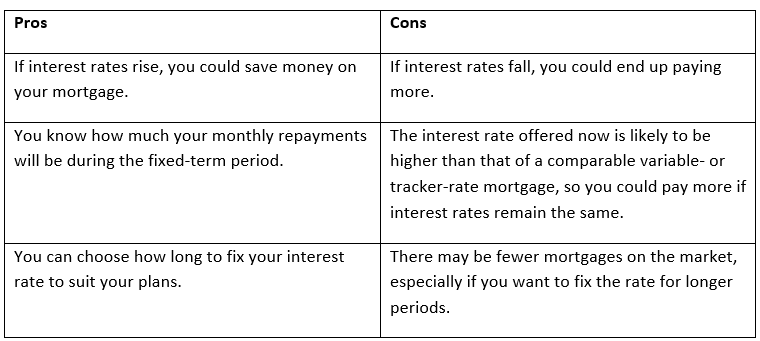

If interest rates are likely to rise, it can be tempting to switch to a fixed-rate mortgage now. There are pros and cons to choosing a fixed-rate interest mortgage that you should weigh up.

If your mortgage deal has not yet come to an end, you should also keep in mind that you could face an additional fee if you switch early.

Remember, the interest rate isn’t the only thing you should consider when applying for a mortgage either. Other areas, such as the flexibility to overpay, can be just as important depending on your circumstances.

Choosing a mortgage and finding the best interest rate for you can be time-consuming and complex, so give us a call for our guidance throughout the process.

Please note:

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.