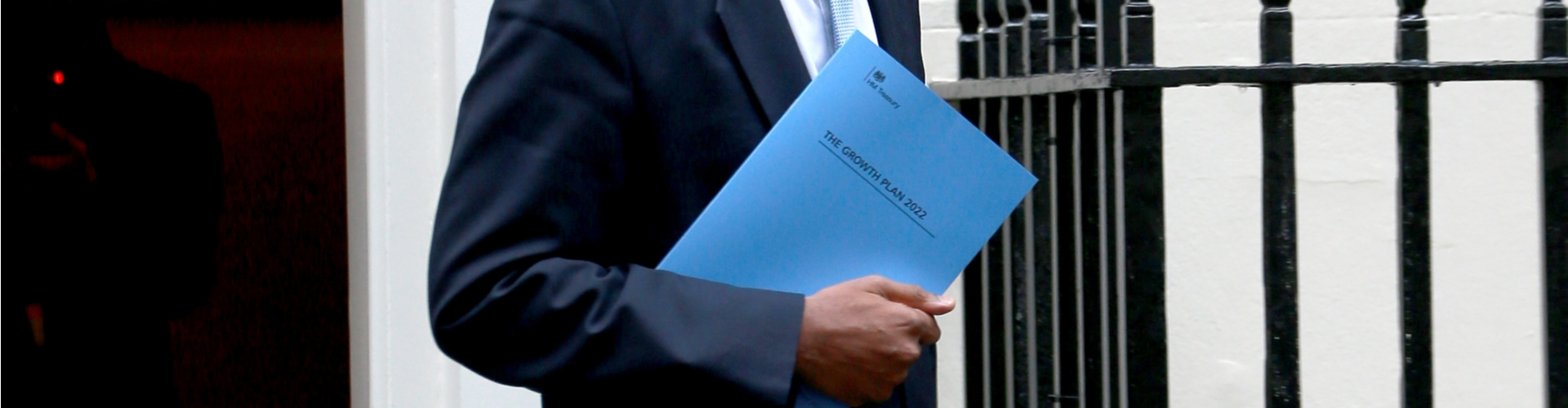

You will probably have been reviewing the outcomes of the modestly described ‘mini Budget’ from Friday’s statement by Chancellor Kwasi Kwarteng. The event sent a shockwave through financial markets, as he announced a series of tax cuts and higher borrowing that challenged economic orthodoxy and will long be remembered by economists and political observers alike.

The announcement was followed by a 3% fall in the value of the pound compared to the US dollar, a 2% fall in share prices on the London Stock Exchange and a sharp rise in the interest rate that the UK pays on longer term borrowings1 . Such events are typically accompanied by sensational headlines that naturally cause concern among investors.

Before examining the specific impact of the budget, it’s worth reminding ourselves why events such as this are so dangerous. Although financial markets are a relatively new phenomena, the way we, as human beings, react to surprises has changed very little for thousands of years. When confronted by a surprise, we automatically assess whether that surprise contains a ‘threat’. We typically respond to that threat in one of three ways, known as the “fight, flight or freeze” response. While our instinct to respond in this way has been an advantage for our species over most of our history, it can lead to us making poor decisions when faced with a modern threat such as turmoil in investment markets.

At its worst, it can lead to us sell sound investments at low prices. This in turn can prevent us from reaching our financial goals. We must therefore be cognisant of our own instincts and apply a deeper level of analysis to the current situation. As we do this, the first point to remember is that investing is always a long term pursuit. Prices are likely to remain volatile over the coming weeks and months as emotions drive the behaviour of most investors. But as months become years, prices will more closely reflect the economic characteristics of the asset.

Legendary investor Ben Graham put it best when he said that “in the short run the market is like a voting machine, tallying up which firms are popular and unpopular. But in the long run, the market is like a weighing machine, assessing the substance of a company.”

When selecting investments, it is important to always consider the time period over which their planning to invest and think about returns and risk in that context as they focus on keeping you on track to meeting your long term goals.

It’s clear the sharp price movements we’ve witnessed in investment markets have changed the landscape for investors. First, we should note that the UK stockmarket is very different from the UK economy. Over 75% of the revenues of the largest 100 companies listed on the London Stock Exchange are derived from overseas2 . In many cases these profits will be boosted by Friday’s decline in the value of the pound. This combination of higher profits and lower share prices improves the attractiveness of UK shares and should lead to higher long term returns. Equally, the rise in the interest rate on government bonds increases the return that investors receive when lending money to the UK government and companies. It is therefore a better time to own long term assets than before Mr Kwarteng stood up at the dispatch box on Friday. However, few investors will view the situation in this way, preferring instead to focus on the immediate fall in prices.

However, it is also a reminder of the importance of owning a diversified portfolio of investments that contains both UK and overseas assets, managed by experienced professional investors.

If you would like to know more about how your portfolio is being managed, please don’t hesitate to get in touch.

Important Information

Past performance is not a guide to future returns. The value of investments may go down as well as up and an investor may not get back the amount invested. The information, data, analyses, and opinions presented herein are provided as of the date written and are subject to change without notice.

1 Source: Reuters 23rd September 2022

2 What Investors Need To Know About The UK Stock Market – Forbes Advisor UK 19 July 2022

John Sangster

Director – Chartered Wealth Manager & Head of Investments