Mortgage repayments are accounting for a larger proportion of household expenses as interest rates rise. If you’re searching for your first home, understanding what is affordable is essential for managing your budget.

Over the last year, the Bank of England has increased its base interest rate to tackle surging inflation. As of March 2023, the base rate is at a 14-year high. Coupled with rising property prices, it means mortgage repayments could be higher than you expect.

As a first-time buyer, it’s essential you understand what your outgoings are likely to be and that you feel confident you can meet them.

Housing affordability is “well above” the long-run average

Andrew Harvey, a senior economist at Nationwide, said: “The biggest change in terms of housing affordability for potential buyers over the past year has been the rise in the cost of servicing the typical mortgage as a result of the increase in mortgage rates.”

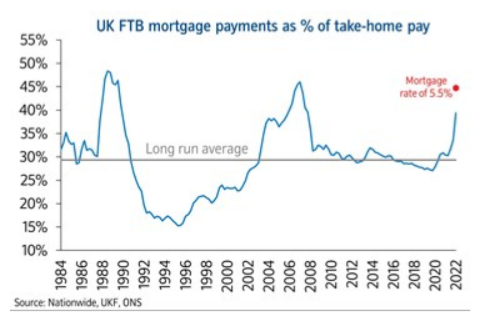

According to Nationwide analysis, an average first-time buyer that puts down a 20% deposit is spending 39% of their take-home pay on mortgage repayments. The bank describes this as “well above” the long-run average and close to levels seen in the run-up to the 2008 financial crisis.

The graph below shows how mortgage repayments for first-time buyers have changed over time, and the level it could reach if interest rates continued to rise to 5.5%.

It means first-time buyers need to carefully consider their outgoings and understand how the interest rate they accept will affect their expenses.

What is “affordable” for you?

There are lots of “rules” people share when you’re buying your first home, including how much of your income should go towards paying your mortgage.

You may have heard that no more than a third of your post-tax income should go towards mortgage repayments. Others may suggest your total essential outgoings shouldn’t exceed two-thirds of your income.

While these “rules” can be a useful starting place when you’re trying to understand what’s affordable, you need to take some time to review your own circumstances.

If you have other forms of debt you’re paying or higher than average outgoings in other areas, it may mean that mortgage repayments that are deemed affordable are too high for you. On the other hand, if you live in an expensive area, it could mean you have little choice but to purchase a property that would mean your mortgage repayments exceed the suggested percentage.

Creating a household budget before you make an offer can help you understand how becoming a homeowner will change your finances. Noting down all your expected household expenses, from utility bills to savings, is a good starting point. Make sure you give yourself some leeway in case an outgoing is higher than you forecast.

You should take a look at the property market to see how much you’re likely to pay for the home you want.

A mortgage in principle can then help you understand how much you’re likely to be able to borrow and the cost of servicing your mortgage. We can help you find a mortgage lender that’s right for your circumstances and answer questions you may have about repayments.

When you apply for a mortgage, the lender will carry out their own affordability checks. This will include looking at your income and expenses to weigh up how likely you are to default on repayments.

Assessing your affordability first means you can feel more confident when submitting your application. It could also help you identify and resolve potential red flags before you apply to improve the chances of a mortgage lender accepting it.

Please note:

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

Your home may be repossessed if you do not keep up repayments on a mortgage or other loans secured on it.