It seems almost glib to be discussing the financial impact of the horrific events unfolding in Ukraine however we have a duty of care as investment professionals to digest and assimilate this information in the context of our clients’ investments.

We’d like to keep you updated with our early observations regarding the Ukrainian / Russian concerns and open a dialogue if you want to discuss your financial plan.

Let’s start with perspective about the Ukraine/Russian situation. This geopolitical event is concerning on practically every level, leaving a wide range of potential outcomes and scenarios. Putting aside views on the way this might evolve, our role is to look at this financially and ensure clients are secure. This requires us to avoid prediction and instead use multiple layers of thought.

Our first layer of thought is to ensure you are secure personally. As we look at our client’s standard of living, we can expect a further rise at the petrol pump and of prices in general, but we’d expect most to weather this quite relatively easily. You may not foresee anything else adversely impacting you, but to create a ballast against anything denting your financial progress (which may or may not happen), we encourage you to continue maintaining a safety net of cash.

The second layer is the robustness of your portfolio, including potential knock-on effects. In financial markets, many industry professionals are trying to grapple with this; especially the potential consequences of Russia’s actions and subsequent sanctions from the West. Direct Russian exposure tends to be limited to its inclusion within Emerging Market asset allocations where it generally forms less than 0.5% of the overall portfolio. Indirectly, the decision by many western companies to withdraw the supply of goods or services to Russia in support of Ukraine will have an impact, albeit limited, on 2022 earnings.

Events are moving very quickly but I have provided a summary of the sanctions that have been put in place against Russia thus far:

- Many Russian banks have been cut off from the SWIFT international payments system

- Russia’s central bank had its assets frozen limiting their ability to support the Russian ruble.

- The ruble has fallen over 20% and to support the currency they raised interest rates from 9.5% to 20.0%

- Russian aircraft including private aircraft owned by Russian oligarchs have been banned by many countries from flying in their airspace & with many suppliers refusing to do business with or in Russia the ongoing maintenance of these planes is likely to be short lived.

- Both the US & UK have moved to ban the import of Russian oil.

- Gas has so far been excluded from sanctions but paying for supplies may be difficult. In any event, it seems Russia has cut supplies and shipments through the Black Sea ports.

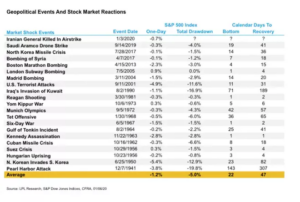

Using the S&P Dow Jones Indices as a proxy for the global markets, research collated in June 2020 shows the impact that conflict has on world markets looking as far back as Pearl Harbor in 1941. The table below shows that on average the “bottom” occurs 22 days into the conflict, with a recovery to pre-conflict market levels taking place within 47 days. Post 2000 this average number of days to market recovery falls to just 19 days perhaps reflecting the more wide spread availability of information in the age of the internet.

We are monitoring this situation closely and are keeping a close eye on events as they unfold, their impact on markets and subsequently your portfolio. Given what we do know, we recognize the need to remain calm and focus on the benefits a long-term approach to investment has to eventual returns whilst not being fearful of short-term volatility.

As always, please don’t hesitate to contact us if you have any questions or issues. Please email us at info@rpgcfp.co.uk or call 01745 582 933.

Finally we would like to emphasise our total support for the people of Ukraine and our hopes for a swift return to peace.