Dividend Tax rates are set to rise, and it could affect the amount of tax you pay.

The chancellor announced a hike in Dividend Tax rates, along with the introduction of a new Health and Social Care levy, to help plug the gap in public finances after the pandemic. The government has said that some of the money raised through the increase will be used to clear the backlog the NHS is experiencing and to support social care costs.

A dividend is a regular payment of profit made by a company. If you’re an investor, some of your investments may be in dividend-paying companies. If you’re a company director, you may also choose to pay yourself in dividends.

Understanding if you could be affected by the new tax rates is important, as it can allow you to take steps to reduce the additional tax due.

Will you be affected by the Dividend Tax rate rise?

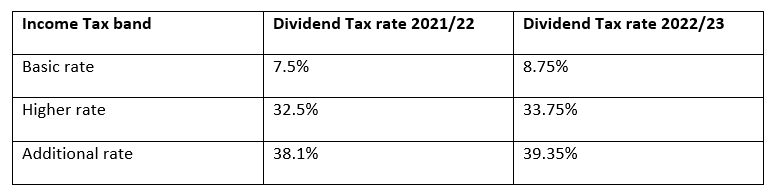

From the 2022/23 tax year, Dividend Tax rates will increase by 1.25 percentage points.

The Dividend Allowance will remain the same. So, if you receive £2,000 or less from dividends during a tax year, you will not have to pay tax on this income. If your dividends exceed £2,000, your tax band affects the rate you pay. The table below shows how your Dividend Tax rate will change.

How the rate hike will affect you will depend on the dividends you receive. The government estimates that affected taxpayers will pay on average £150 more on their dividend income from 2022/23. For higher-rate taxpayers, the estimated additional tax is £403.

5 steps that could reduce your Dividend Tax liability

1. Make full use of your Dividend Allowance

Making full use of your Dividend Allowance each tax year can help you generate an income that is free from tax. Keep track of the dividends you receive. In some cases, delaying taking dividends until a new tax year if you have control of this can help.

2. Plan as a couple

Each individual receives a Dividend Allowance, so planning as a couple can maximise the amount you can receive in dividends before tax is due. Passing on some dividend-paying stocks to your spouse or civil partner can effectively mean you’re able to receive up to £4,000 through dividends without paying tax.

3. Maximise your ISA allowance

If you’re making an income from investments, an ISA is a tax-efficient way to invest.

Dividends on shares within an ISA are tax-free and won’t impact your Dividend Allowance. Any profit you make when selling investments held in an ISA won’t be liable for Capital Gains Tax either. As a result, using an ISA to hold your investments can make sense from a tax perspective in the short and long term.

For 2021/22, you can place up to £20,000 a year into an ISA. You must use this allowance during the tax year as it cannot be carried forward. Again, the ISA subscription limit is for each individual. So, if you plan as a couple, you can add up to £40,000 into ISAs collectively.

4. Consider growth investments

When investing, you can do so to deliver an income or for growth. If your investment income exceeds the dividend allowance and you don’t need the income for day-to-day spending, switching to growth investments may be right for you.

Rather than paying out, a growth investment strategy will focus on investments that are expected to go up in value to deliver a return when you sell them. This strategy can reduce the amount you receive in dividends, so you don’t exceed the tax threshold.

However, keep in mind that you could still pay tax on these investments. When you dispose of an asset for a profit, Capital Gains Tax may be due. For the 2021/22 tax year, the Capital Gains tax-free allowance, known as the “Annual Exempt Amount”, is £12,300.

As with the Dividend Allowance, making full use of the Annual Exempt Amount each tax year, and planning as a couple, as the allowance is per individual, can help reduce tax liability.

5. Speak to a financial planner

Tax rules can be complex and while you may take steps to mitigate Dividend Tax, you could find your tax liability increases overall. We’re here to help you understand what steps you can take to reduce Dividend Tax and make the most of your money. There may be other steps that are appropriate for you, and we will explain the options you have.

Please note:

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.