Significant changes to Inheritance Tax (IHT), were announced in the Autumn Budget 2024. Draft legislation was finally published in July 2025 which has given us a better understanding of the changes and how they will impact business owners, farmers and pensions in particular.

As many of the changes start to take effect from 6th April 2026, there is a limited amount of time now available to review your position and potentially to mitigate your IHT exposure.

Below we summarise the key reforms, and financial planning team from RPG Chartered Financial Planners and the specialist tax team from RPG Chartered Accountants highlight potential strategies that should be considered to reduce the impact of the changes on your estate.

We would be very happy to discuss these options with you. Please call your usual contact at RPG Chartered Financial Planners or email info@rpgcfp.co.uk.

Key Inheritance Tax Changes from the Autumn Budget 2024

1. Extended Freeze on IHT Thresholds

The nil-rate band (£325,000) and residence nil-rate band (£175,000) remain frozen until 5 April 2030.

The freezing of the nil-rate band, unchanged since 2009, means more estates will become liable for IHT due to asset inflation.

2. Reforms to Agricultural Property Relief and Business Property Relief (APR & BPR)

Currently the value of assets to which BPR and APR may apply is unlimited. However, from 6 April 2026:

- 100% relief applies to the first £1 million of combined qualifying agricultural and business assets.

- Assets exceeding this threshold receive 50% relief, resulting in a 20% effective IHT rate.

- It should be noted for shareholders owning less than 100% of the shares in issue the value of your shares on a sale could differ to the value of the shares on death as minority discounting may be appropriate.

- AIM-listed shares will only qualify for 50% relief (a 20% effective IHT rate), regardless of value.

3. Inclusion of Unused Pension Funds in IHT

From 6 April 2027, unused pension funds and death benefits will be included in the deceased’s estate for IHT purposes resulting in a potential IHT charge of 40%.

For those over age 75, their dependants will also pay income tax on the benefits they draw resulting in an effective tax liability of up to 67%.

HMRC have confirmed that Death in Service and Relevant Life Plans will remain exempt.

HMRC have also confirmed that pensions that hold BPR/APR qualifying assets will not qualify for any IHT relief in respect of those assets.

Personal Representatives will be responsible for reporting and paying any IHT due on the deceased’s estate and pension fund. The pension scheme administrator can pay the IHT directly from the pension fund if the liability is greater than £4,000.

The addition of the value of pension funds to an individual’s death estate, may well impact on the availability of the Residence Nil Rate Bond (RNRB).

4. Shift to a Residence-Based IHT System

From 6 April 2025, liability to inheritance tax will be based on UK tax residence rather than domicile.

- The estates of individuals who have been tax resident in the UK for at least 10 out of the previous 20 tax years will be subject to IHT on their worldwide assets.

- Those who leave the UK and become non-UK residents will remain within the scope of IHT on their worldwide assets for up to 10 years.

- The estates of long-term non-residents will only be liable to IHT on UK assets.

Potential Strategies to Mitigate IHT

1. Lifetime Gifting

- Utilise the annual gift allowance (£3,000 per donor) and consider larger gifts, which become exempt if the donor survives seven years.

- If regular gifts are made out of surplus income, they are immediately outside of your estate.

2. Trust Planning

- You might consider transferring assets that attract Business Property Relief (BPR) and/or Agricultural Property Relief (APR) at 100% into a trust prior to 6 April 2026 to:

- a) retain overall control and

- b) transfer value from your estate in a way that will be significantly restricted from 6 April 2026.

If you survive seven years from the date of the gift, then the gift falls outside your estate for IHT purposes.

- You need to consider that gifts are treated as a disposal for Capital Gains Tax (CGT) purposes although holdover relief should be available subject to a certain qualification criteria.

- Transfers made before 6 April 2026, will be subject to transitional rules. If you make a transfer into a trust before April 2026 then the cap of £1m will not apply when calculating the IHT due on the chargeable lifetime transfer (CLT). Provided you survive seven years, no further IHT will be due in respect of the transfer into trust and the value of that transfer will not be included for the purposes of determining the amount of the £1m cap available for future transfers of BPR or APR assets or when assessing the IHT on these assets in your estate.

- If you die within seven years, and after 5 April 2026, then the new rules apply, and IHT will be due on the amount over £1m although tapering will apply after 3 years. This will also be treated as utilising the £1m allowance available to the estate.

- In essence, the transfer of BPR/APR assets into a trust provides the potential to divest material assets that could after 5 April 2026 be taxed at 20% however the assets are only fully outside the IHT charge on surviving seven years due to the transitional rules.

3. Accelerate succession planning

- Under current rules there is an incentive to pass business assets only on death if Business Property Relief is available at 100%. This has the added benefit of resulting in a tax-free re-basing of the allowable cost of the assets to market value on death, thereby reducing future capital gains tax liabilities, e.g. if the business is ultimately sold.

- If BPR relief at 100% is restricted to the first £1 million of value, then it may be preferable to make earlier transfers to the next generation.

- For trading businesses, it should be possible to achieve this with no or minimal capital gains tax liabilities if the conditions for gift hold over relief are satisfied.

- Further options could include a ‘family buyout’ whereby the next generation purchases the business.

4. Growth shares

- Growth shares offer an opportunity to ‘cap’ the value in your estate.

- If correctly structured, future growth in value will accrue to the growth shares which could be held by the next generation or on trust for their benefit. This would ensure that future growth in the value of the business would be outside of your estate.

5. Review the ownership of assets

It’s common, that as a company expands, perhaps incorporating new subsidiaries, that it comes to include a range of non-trading activities, e.g. where profits have been reinvested into assets such as property.

This can have implications for the availability of BPR on the shares.

It’s important to ensure that where there is a mix of activities that BPR is not restricted or lost entirely and, if appropriate, take steps to separate out investment activities (which will not qualify) from business activities (which may).

6. Insurance

- Consider insurance policies which would pay out on either first or second death and which would contribute to meeting any inheritance tax liability.

- The premiums will depend on health/life expectancy, etc. but if taken out early can be cost effective.

- Insurance can also be helpful where a gift has been made which would become liable to inheritance tax if you died within seven years of the date of the gift. This type of insurance is called a Gift Inter-Vivos policy, the sum assured decreases annually to match against the IHT liability on the gift over the 7-year term.

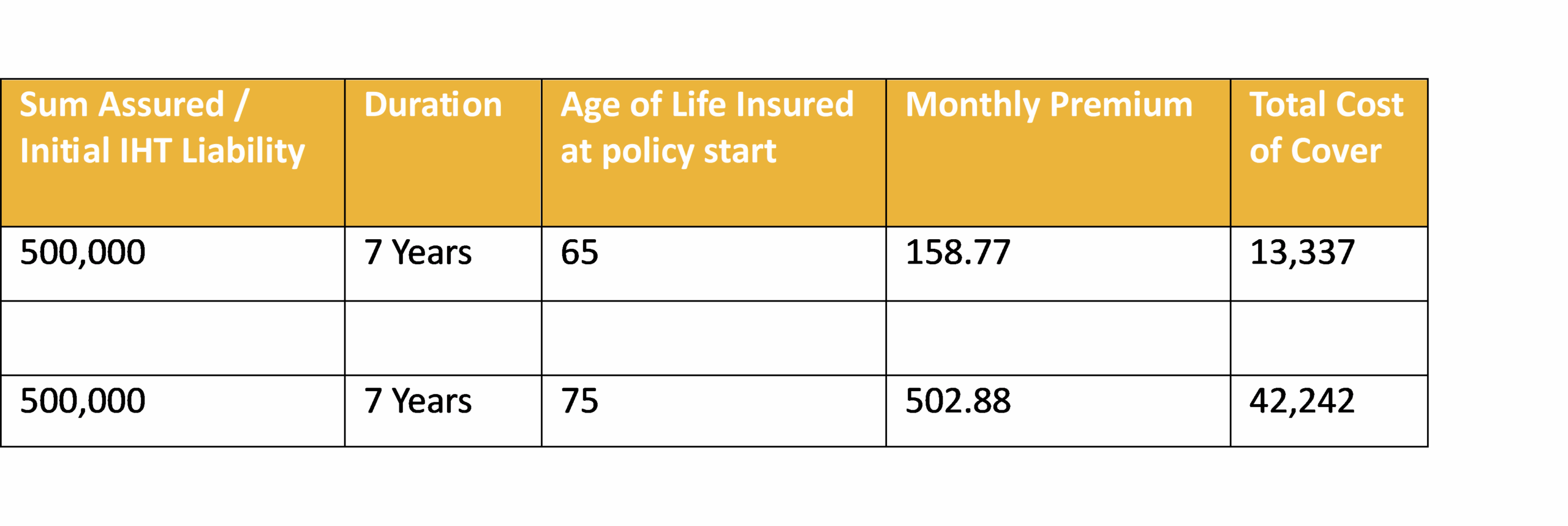

Examples of the cost of Gift Inter-Vivos policies on a single life for a 65-year-old or 75-year-old could be as follows:

The above quotes are for illustrative purposes only, any application would be subject to underwriting.

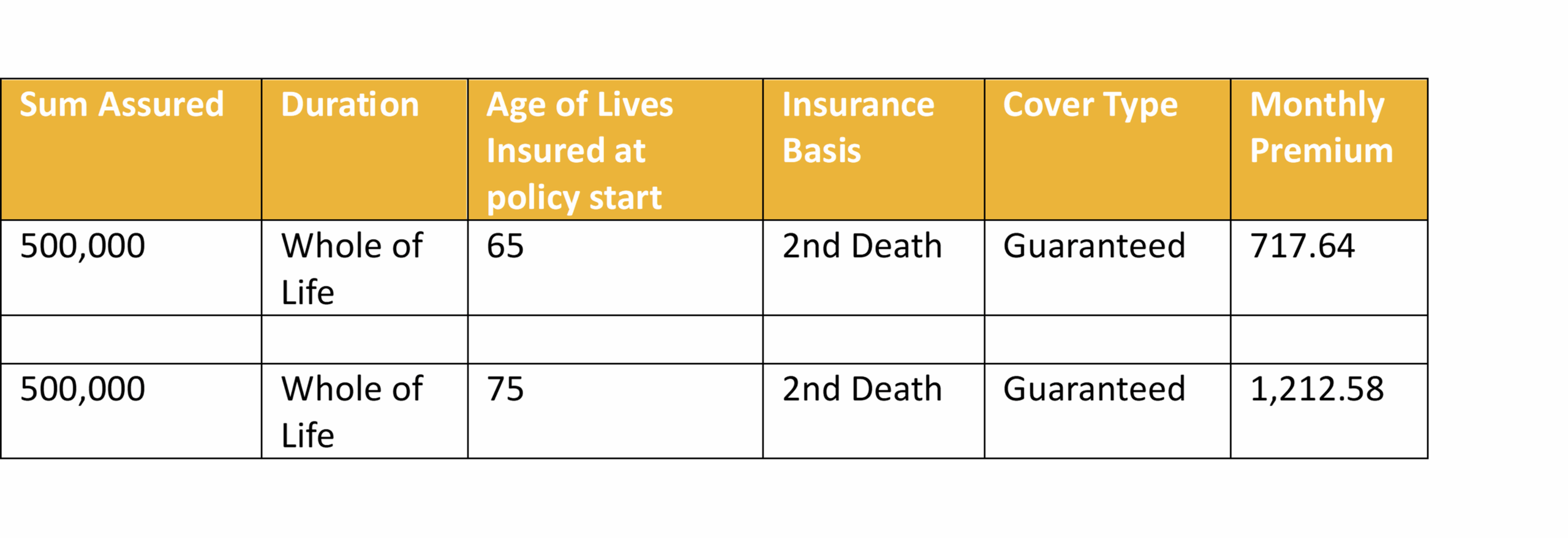

An example of a Whole of Life, 2nd death policies for a 65-year-old and 75-year-old couple could be as follows:

The above quotes are for illustrative purposes only, any application would be subject to underwriting.

7. Pensions

Consider drawing down pension funds during your lifetime to reduce the IHT liability on death, this could either be used to fund your lifestyle or make gifts. A gift of capital (say the tax-free cash) would be outside your taxable estate after seven years. A gift of income that was deemed surplus to your needs (provided HMRC conditions are met) would be outside your estate immediately.

Review pension nominations and explore alternative retirement income strategies. The spouse exemption is likely to be an important consideration

8. Asset Reallocation

Reassess holdings in AIM shares and other business assets in light of the reduced reliefs.

Explore diversifying investments to optimise tax efficiency.

9. Residence Planning

The replacement of ‘domicile’ with long-term residence as the deciding factor for liability to UK inheritance tax opens up potential planning opportunities for those who are currently overseas or contemplating emigration.

While it is possible under current rules to lose one’s UK domicile and acquire a domicile of choice elsewhere, there can be considerable uncertainty as to when domicile is lost and acquired due to its broad definition.

Under the new rules there will be greater certainty given it is based on residence, a question of fact.

Long-term non-residents may therefore already be outside the scope of UK inheritance tax, at least in respect of non-UK investments, while UK residents who are contemplating leaving the UK will have the certainty, provided they manage their UK residence position, that after ten years, only their UK assets are potentially within scope.

10. Review and update wills

You should review existing wills to ensure that arrangements are still appropriate given the new rules. It’s important that the Wills protect the £1m BPR/APR relief post 5 April 2026 and the inclusion of a Business Property Trust is likely to be appropriate.

11. Planning for payment

While it may be possible to mitigate the impact to some extent, it may also need to be accepted that there will be a liability to be paid.

Family businesses and farms should therefore consider how the business might fund the payment of any liability.

Having a clear idea of how the liabilities might be funded may bring into focus the importance of earlier transfer of ownership to the next generation if the liabilities would prove insurmountable.

If the funds are to be paid by the business itself, this could be particularly inefficient given the potential tax liabilities on extracting funds from the business to pay the IHT liability by way of dividends. It may instead be possible to extract funds more tax efficiently by way of a company purchase of own shares.

12. In Summary

This summary has been produced to highlight the key IHT related tax changes emanating from the Autumn 2024 Budget and to provide an example of solutions that could reduce the tax burden on your estate

As some of the changes become effective from 6th April 2026, it is advisable to start to consider your options as soon as possible and we would be very happy to support you in this process. Please call your usual contact at RPG or email info@rpgcfp.co.uk. to discuss with RPG’s specialist financial planning and tax teams.

Click here to download a copy of this RPG Briefing: Changes to UK Inheritance Tax

Last date reviewed September 2025 – please do not rely on this document alone and seek advice to take into account your own circumstances.