Stocks & Bonds are falling, there is political turmoil & high inflation, how to navigate uncertain times.

You will have no doubt seen all the coverage in the media of inflation, recession and lots more. Indeed, these are remarkable times.

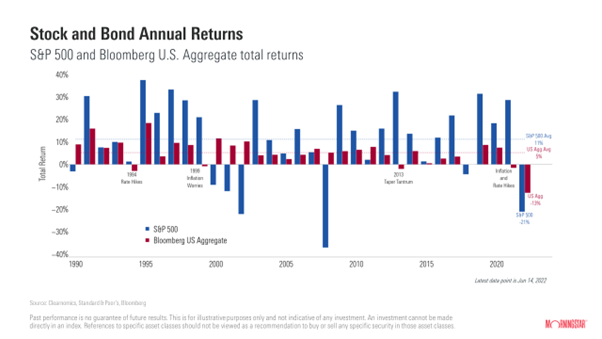

One of the unusual features we are dealing with is that stocks and bonds are falling at the same time. So, while the broad stock market hasn’t fallen by as much as other periods (such as the 2020 COVID crisis or the 2008 financial crisis) the bottom line has been impacted in the short term. No losses are comfortable, even the short-term recoverable ones, but if we take a longer-term view it actually has some positives associated with it. For example, one major positive is that dividend and bond yields have increased meaningfully. All else being equal, this means many holdings in your portfolios are in a much better position going forward.

Retirees and the more cautious investors may feel particularly concerned, with inflation pinching budgets at the same time as volatile investment portfolio values. Additionally, the uncertainty created by the political upheavals in western democracies, together with the longer-term impact of the COVID pandemic and the war in Ukraine, have eclipsed the financial characteristics of the investments that people own and directed their attention towards politics and security. The impact is confidence-sapping.

The combination of poor returns and a troubling geopolitical backdrop can promote behaviour that may permanently damage an investors’ ability to reach their financial goals. We understand the allure of cash-reigns -supreme at times such as these (the so called “cash is king” mentality), but it is important to remember that cash has a terrible track record of keeping up with inflation, so is a near guaranteed way to lose purchasing power.

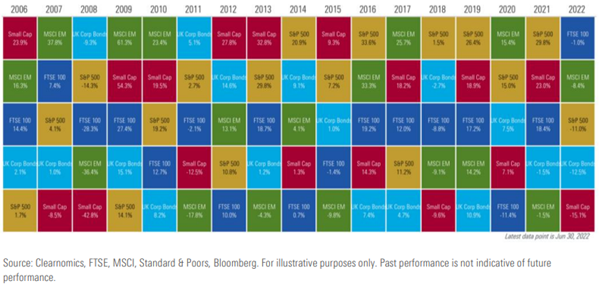

As humans, we have a tendency to concentrate on our most recent and vivid experiences and extrapolate those experiences forward. This leads us to be more adventurous when we have recently experienced gains and more cautious when we have experienced losses. It also explains the habitual problem of investors buying high and selling low.

The Long Run for U.K Asset Classes in GBP Terms

One way of countering this tendency is to contextualise recent returns as part of a longer term journey towards an end goal.

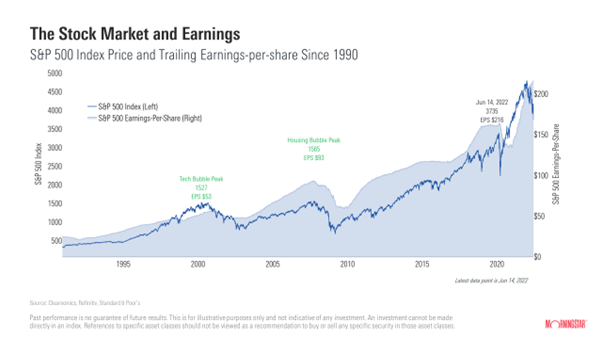

When thinking about downturns, it is important to stay a couple of steps ahead of the pack. This might sound obvious, but the reason is actually premeditated. The market tends to front run the economy both on the decline and the rebound. So, near the peaks, market participants will begin pricing in bad news before it actually happens (like we’ve witnessed this year). Conversely, near the bottoms, markets tend to bounce well before the bad news stops. Timing these points is not a game we recommend anyone play.

Finally, political turmoil.

Often the biggest risk in situations like this is reacting impulsively to the fears stoked by headlines in the media. But I’d like to remind you that politics and investing are two distinctly different areas, with predicitions about market connections often far from accurate. To illustrate the point, consider the following quotes from the 2015 U.S. election and the 2016 Brexit referendum, where even the smartest people got it grossly wrong!

U.S. Election Predictions Surrounding Donald Trump (U.S. stocks rallied around 9% in the three months following.)

“We would expect a small global stock market rally if Clinton wins (about 2%) and a large decline if Trump wins (about 10%).” —Eric Zitzewitz, professor of economics at Dartmouth College

“The S&P 500 will fall by 3% to 5% immediately if Trump is elected.” —Tobias Levkovich, Citigroup’s chief U.S. equity analyst

“If investors are wrong and Trump wins, we should expect a big markdown in expected future earnings for a wide range of stocks—and a likely crash in the broader market.” —Simon Johnson, professor at MIT Sloan School of Management and former chief economist at the International Monetary Fund

Brexit Referendum Predictions (U.K. stocks fell 3.15% the day after the referendum but gained around 13% in the six months following. Economic growth also continued to rise.)

“A vote to leave would tip our economy into a year-long recession with at least 500,000 U.K. jobs lost.” —George Osborne, former chancellor of the exchequer under Prime Minister David Cameron

“Leaving Europe would tip the country into recession.” —David Cameron, former prime minister

“Brexit would trigger recession,” predicted -0.3% GDP for Q3 2016. —IMF forecasts

Errant predictions help us to remember that political uncertainty is nothing new. As always, we must choose research over reaction, and I urge you to stick to the financial plans we made together at a calmer time.

We will continue to monitor proceedings and will keep you informed if anything material ensues. Regarding your portfolio, it is for circumstances like this that RPG has always endorsed a diversified approach when managing money. That is to avoid going “all in” on any potential outcome because we believe it’s impossible to know which one will happen.